The official opening of the first branch of Bank of Baroda (BOB) in Auckland on February 4 should herald a new chapter in New Zealand’s banking sector, for, as one of the largest commercial banks in India, it would understand the needs of its customers better than most others do.

Although New Zealand’s youngest commercial bank became operational in June 2010, its official opening by India’s Minister of State for Finance Namo Narain Meena in the presence of the Bank’s Chairman & Managing Director Mangalore Devadas Mallya, Indian High Commissioner Retired Admiral Sureesh Mehta, local Directors Dr Rajen Prasad and Vijaya Vaidyanath and others, would set a new landmark.

Bank of Baroda New Zealand (BOBNZ) Limited, a fully owned subsidiary of the parent Bank in India owns and manages the Branch. A number of branches in other areas will follow in due course.

Mr Mallya said BOB functions as the financial heart of the community in all its locations, with a penchant for customer service and satisfaction.

“As well as conforming to the state-of-the-art technology, we have built a culture for customer care. Each of our 36,000 employees functions as a banker and sales and marketing executive, keen to optimise customer satisfaction among our 36 million customers and enlist new clientele,” he told Indian Newslink last night.

He said customer care will also be the focus of the Bank’s operations in New Zealand and that products and services will be structured to meet the market needs.

“While we will provide all banking services to customers in New Zealand, we are also keen to understand their specific requirements and examine the possibilities of meeting them. From corporate, retail and private banking to trade finance, international remittances and helping businesses establish their connections through our extensive network, BoB will be ‘everyone’s Bank.’ Customers can expect a unique banking experience,” he said.

BOBNZ Managing Director Satish Vermani said customer response was encouraging, reflecting a robust performance during the first four months of the operations of the first branch.

BOBNZ Managing Director Satish Vermani said customer response was encouraging, reflecting a robust performance during the first four months of the operations of the first branch.

He said the branch opened more than 1000 accounts and wrote more than $16 million worth of business during the six-month period from June 2010, “indicating the high level of public confidence.”

Mr Vermani said remittances to India were also popular with more than $5 million transferred between June and December 2010.

“Our deposit products include current account, savings, premium savings, recurring deposit schemes and fixed deposit schemes for varied maturities. These products are offered to individual as well as business entities.

“The Bank offers loan and advances to the retail segment, small and medium enterprises, professionals and corporate clients. We also provide home loans, overdraft facilities, term loans of short to long term and project finance,” he said.

Mr Vermani said the bank undertakes opening of documentary letters of credit, standby letters of credit and bank guarantee business.

Mr Vermani said the bank undertakes opening of documentary letters of credit, standby letters of credit and bank guarantee business.

He said importers, exporters and distributors dealing with India and other parts of the world can also expect prompt and efficient services (see our Importers and Wholesalers Special Report in this issue).

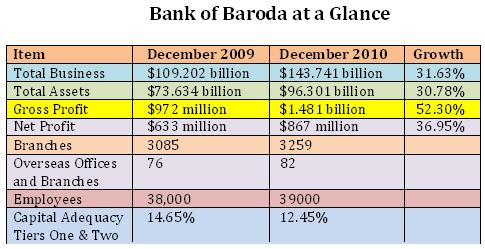

Mr Mallya said despite difficult market conditions, BOB maintained a good balance sheet during 2010, improving its performance over the previous year.

“We were honoured to receive the ‘Banker of the Year Award (India)’ presented by ‘The Banker’ of London. We were also gratified that ‘Business India,’ a leading fortnightly business publication honoured us with the ‘Best Bank 2010’ Award, which covered the entire banking sector in India,” he said.

The Bank won the ‘Financial Inclusion Award 2011’ (by Skoch Consultancy Services Private Ltd) for tapping the potential unskilled unemployed youth, and three awards from Association of Business Communicators of India.