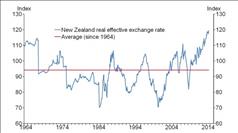

The New Zealand dollar exchange rate is at exceptional levels compared with its history. The Trade Weighted Index (TWI) is above its 90th percentile calculated from historical data.

The New Zealand dollar exchange rate is at exceptional levels compared with its history. The Trade Weighted Index (TWI) is above its 90th percentile calculated from historical data.

Relative to the US dollar, Japanese yen and the euro the exchange rate is above the 90th percentile. It is close to the 90th percentile against sterling and the Australian dollar.

Three major factors

There are sound reasons why the New Zealand dollar should have strengthened in recent years. Three factors have been particularly important in stimulating demand for New Zealand dollar denominated assets.

First, rising export commodity prices lifted New Zealand’s terms of trade late last year to their highest level since 1973, and about 40% above the average level of the 1990s.

China’s expanding urbanisation and growing demand for protein drove much of this. China is now New Zealand’s main export destination, having increased its share of New Zealand’s exports from 5% to 21% over the past decade.

Second, investors have also been attracted by the broad strength of the economy and our higher interest rates. Over the past three years, New Zealand’s annual GDP growth has been 1.3 percentage points higher than the average of the advanced economies.

The differential between New Zealand’s Official Cash Rate (OCR) and policy rates in other advanced economies, which had been of the order of 1.5% to 2% since 2009, began to widen in late 2013 as markets factored in the prospect of OCR increases.

Countries that cumulatively produce around two-thirds of global output have policy rates between 0% and 1%, with most having rates close to zero.

Meanwhile, the Reserve Bank increased the OCR by 1 percentage point over the period from March to July 2014.

Third, and related to the previous point, the weak and uneven recovery in the advanced economies has seen many central banks adopt unconventional monetary policy as the lower bound on short-term policy rates was reached.

Central banks in large advanced economies have kept policy interest rates close to zero and injected over US$6 trillion of liquidity into global financial markets.

This inflated prices of financial and real assets, depressed yields and compressed spreads on risk assets. Yields on 10 year sovereign bonds in Germany were recently at an all-time low, France and Spain reached 250 year lows and the Bank of England’s policy rate is at its lowest level since the Bank’s inception in 1694.

The subsequent ‘search for yield’ by investors, coupled with excess liquidity and low levels of financial market volatility, generated substantial portfolio inflows into New Zealand and put upward pressure on the exchange rate.

Savings gap

An additional factor exerting upward pressure on the exchange rate over many years has been the persistent gap between savings and investment. Over the past 40 years, New Zealand has demanded more investment in housing, infrastructure and other assets than its domestic savings could finance.

New Zealanders’ relatively high propensity to spend means that interest rates need to be higher than elsewhere to achieve similar inflation outcomes. The higher interest rates are also needed to fill the domestic savings gap by attracting the savings of foreigners. This has the effect of putting further upward pressure on the exchange rate.

When assessing the implications of current strength or weakness in the New Zealand dollar, the Bank focuses on two broad concepts, namely, whether the exchange rate is unjustified and whether it is unsustainable.

The Bank examines the real effective (or trade weighted) exchange rate when making this assessment.

This corrects the nominal effective exchange rate for differences in relative prices (or relative unit labour costs) between New Zealand and its major trading partners. It is a better measure of overall competitiveness than the nominal exchange rate.

An exporter’s competitiveness is determined not just by the nominal exchange rate, but also by their cost of doing business relative to their foreign competitors.

Deviating factor

The level of the real effective exchange rate is considered unsustainable when it is clearly deviating from its long-run equilibrium. That is, from where the exchange rate would be expected to settle when business cycle factors have fully dissipated. The long run equilibrium exchange rate will be consistent with external balance over the long term, given certain assumptions regarding the terms of trade, domestic and world growth rates, interest rates, and external debt levels etc.

Persistent deviations from equilibrium are likely to result in external debt ratios that eventually become unmanageable and misallocations of resources that inhibit the country’s long term growth potential.

The Bank considers that the real effective exchange rate is unjustified when the level of the real exchange rate is inconsistent with the economic factors that typically explain its movement during the business cycle.

Economic models

The Bank uses a range of short term economic models to assess whether the real effective exchange rate is unjustified.

These models can normally explain much of the cyclical fluctuation in the real exchange rate.

For example, economic variables such as commodity prices, house prices and relative interest rates can account for much of the movement in the deviation of the real effective exchange rate from its long term average level.

It is important to note that these cyclical variables are not necessarily the underlying cause of the movement in the real exchange rate. They can be proxies for broader considerations such as the strength of the economy and the expected returns from investing in New Zealand that investors compare against other international investment alternatives.

Graeme Wheeler is Governor of the Reserve Bank of New Zealand. The above is a part of a Statement that he issued last week. For full text of the Statement titled, ‘New Zealand’s Exchange Rate: Why the Reserve Bank believes its level is unjustified and unsustainable,’ please visit www.rbnz.govt.nz