New Zealand economy is showing signs of growth again.

Consumer spending has increased and rebuild activity in Canterbury is gaining momentum.

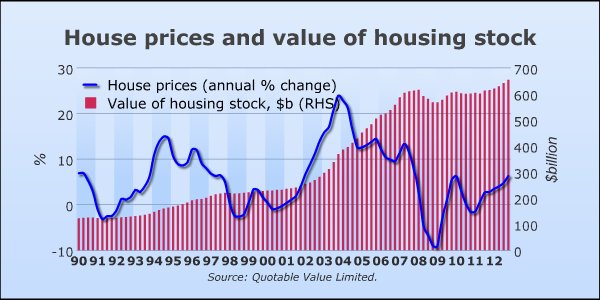

The rate of inflation in the housing market of some regions is high and the Reserve Bank of New Zealand (RBNZ) has retained its Official Cash Rate at 2.5%.

As of February 2013, the total amount in residential mortgages nationwide was $181.04 billion, 52.6% was at floating rate. According to RBNZ figures, about 88% of fixed rates were for less than two years.

Supply and demand influence house prices, like most other goods and services. But the property market is unique; it has two main drivers on the demand side of the equation, namely, finance availability and interest rates.

RBNZ Deputy Governor and Head of Financial Stability Grant Spencer said that Christchurch and Auckland were at the centre of the current housing market pressures in New Zealand.

Housing shortage

Speaking at a meeting of the Employers and Manufacturers Association in Auckland on April 8, 2013, he said that shortages were apparent in the cities but for different reasons.

“In Christchurch, the imbalance is being addressed through a major four to six-year rebuilding programme, funded largely by the Government and the insurance sector.

“In Auckland, the housing imbalance is more complex and uncertain. There are clearly supply constraints and high costs of development that should be addressed in the medium to long-term periods,” he said.

According to him, there are also escalating demand pressures in the Auckland market, arising from low interest rates and easier supply of credit.

“It is important that these pressures moderate in order to avoid a destabilising and overshooting of house prices, while additional supply is gradually brought on stream.”

Mr Spencer said that New Zealand should avoid another housing boom, which could potentially be costlier than the last boom, particularly at a time when the economy faces headwinds from an overvalued exchange rate, drought and a substantial programme of fiscal consolidation.

Seeking good advice

Finance is the primary consideration while buying or renovating properties.

Mortgage finance and borrowing is based on current market valuation and expected valuation after the project is complete.

A mortgage consultant provides individuals, families and business owners with financial advice and solutions tailored to their personal objectives.

Based on your financial position, they help you with borrowings and managing any anticipated future risks with the right insurance package. They are usually affiliated to associations like Institute of Financial Advisors (IFA) or New Zealand Mortgage Brokers Association (NZMBA).

IFA is a professional body of practitioners in financial planning, insurance, investment and estate planning, while NZMBA promotes standards of professional and ethical conduct, including expert knowledge, integrity, competency and service to clients, lenders and the public.

Depending on your current financial situation and long term goals, a broker or advisor can help you to decide the best option with respect to floating and fixed mortgages.

You can take advantage of the housing boom, with the advice of a good mortgage broker to add value to your existing or new property.

Bobby Banerjee is a Licensed Building Practitioner (LBP) and a professional member of the Architectural Designers of New Zealand. Read his main article in this Section.

Graph Source: Reserve Bank of New Zealand