The proposed new Tax Policy recently released by the Labour Party is a bold step towards a fairer society, demonstrated more graphically than in the current approach to Capital Gains Tax.

Salary and wage earners are regulated by a system that has been so perfected that they have no avenue to avoid paying tax and they receive little, if any, opportunity for exemptions.

This is not the case with another group of earners who buy and sell property and shares but are exempt from any tax on the gain they make.

The Government knows this is a missing link in New Zealand’s tax architecture but is reluctant to address it.

The Government justifies its lack of courage to address this problem by pointing to what it sees as the complexity involved in developing a system to capture capital gains.

What it refuses to acknowledge is that only two other OECD countries (apart from New Zealand) do not have Capital Gains Tax, namely, Switzerland and Turkey. All our trading partners have a Capital Gains System in place.

I wonder when has something been given up so easily because of the complexity involved in addressing it.

We have the experience from many countries to draw upon and we can “do complex” with the systems designers, technology experts and input from others who have such a system at our disposal.

Unfair, not complex

I wonder what (Prime Minister) John Key’s real misgivings are.

It certainly cannot be about fairness.

Consider this fact. The Tax Working Group noted that there is an estimated $200 billion invested in property in New Zealand but holders of these properties reported net rental losses of $500 million.

With this net loss on such a huge investment, the country not only forgoes the taxes they should be rightly paying but also actually subsidises capital growth in these properties.

With no system to tax capital, the country is losing an important revenue stream.

This inevitably puts pressure on other revenue sources and leads to unfairness towards those who have no exemptions on the income they earn.

A Capital Gains Tax System, carefully designed, will address this unfairness.

A Capital Gains Tax System, carefully designed, will address this unfairness.

New Zealanders have begun to express their support for the System on the grounds of good economics and fairness.

Sam Morgan, the founder of Trade Me is among them. He said he was astounded that he had no tax liability when he sold the Company for $700 million.

Similarly, (prominent businessman and investor) Selwyn Pellet, who sold off his shares and made a gain of $8 million, was not required to pay any tax.

I have spoken to many readers of Indian Newslink, who believe that a Capital Gains Tax at 15% is fair.

Assets sale atrocious

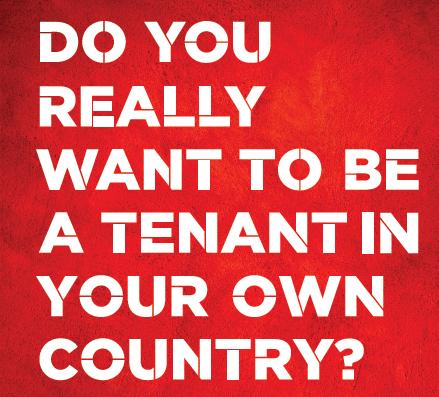

The policy dimension is further complicated by the fact that the Government intends to sell off our strategic assets (Clyde Dam, Air New Zealand, electricity companies and many others) to pay off the debt created by their own tax cuts.

Our assets are not for the Government to sell. We own them and we are happy to use the income they generate for progress and prosperity of all New Zealanders.

It seems to me that whenever National is in Government they do little to create jobs and improve services to New Zealanders.

Their form of laissez faire capitalism simply leaves large sections of our communities to manage as best as they can while advantaging another sector they see as creating wealth.

In fact, capital will never be successful on its own without the input of social capital and skills of our people, families and communities.

Labour will not sell our resources because they are not ours to sell and we want them for our future.

Labour will create a fairer tax system, give families on limited income the hand up they need through the ‘$5000 Tax Free Policy,’ pay off our debts and be fiscally responsible.

Labour has a bold plan for New Zealand, while this Government has none.

Electors have a real choice on November 26 and this will become even clearer as we release our other exciting policies over the coming months.

I ask readers to think about the future they want for their children and grandchildren in New Zealand and encourage them to think about these issues.

Currently, the Government is running a deficit of over $16 billion. They created it and now they want to sell our assets to balance their books.

Labour has a more effective way.

Dr Rajen Prasad is Member of Parliament on Labour List and the Party’s Ethnic Affairs spokesperson. Readers and members and supporters of National Party are welcome to send their views to editor@indiannewslink.co.nz